DIRECTOR IDENTIFICATION NUMBER REQUIREMENTS

From 1st November 2021 the Australian Business Registry Services (ABRS) introduced the Director Identification Number.

The Director Identification Number (Director ID) is a 15 digit unique identifier introduced to prevent the use of false or fraudulent activity, to make it easier to trace director relationships across companies and help identify and eliminate involvement in illegal activity such as illegal phoenix activity.

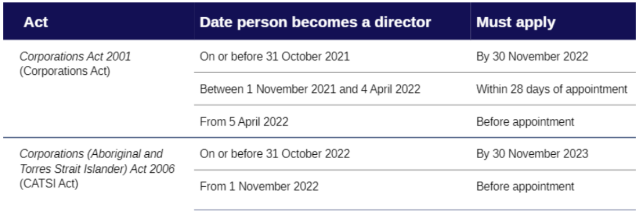

Individuals who were a director at 1/11/2021; who became a director since 1/11/2021 and those that will be acting as a director in the future must apply for a Director ID based on the transitional arrangements specified in the table below:

Digital applications, which the ATO are actively encouraging individuals to use can be made through the ABRS website. The ATO also offer phone applications by calling 13 62 50 or paper applications by downloading the ABRS PDF form.

To apply online, you will need: a myGovID with either a standard or strong identity strength; an individual TFN; residential address as held by the ATO; answer 2 questions based on details the ATO know about you. The two questions will come from the following documents: a bank account you have received a tax refund in or an account that has earned interest in the last 2 years; a Notice of Assessment issued by the ATO in the last 5 years; a Superannuation account statement from the last 5 years; a Dividend statement from the last 2 years; a Centrelink payment summary issued in the last 2 years; a PAYG payment summary issued in the last 2 years.

To apply by phone, you will need: an individual TFN; residential address as held by the ATO; answer 2 questions based on details the ATO know about you; 2 Australian identity documents – one primary and one secondary. Primary documents include: Australian birth certificate; Australian Passport; Australian citizenship certificate; ImmiCard or Visa. Secondary documents include: Medicare card; Australian driver’s licence or learner’s permit. You will be asked to supply a number from these documents.

To apply by paper, you will need: an application form; certified copies of one primary and 2 secondary identity documents. Primary documents include: Australian birth certificate; Australian Passport; Australian citizenship certificate; Foreign passport. Secondary documents include:

Medicare card; Australian driver’s licence or learner’s permit. You will be asked to supply a certified copy of these documents with your application form. Authorised certifiers include: a Barrister, Solicitor, Medical Practitioner, Judge, Justice of the Peace, Minister of religion, Police officer, Bank officer with at least 5 years of service.

Once you have been issued with a Director ID it is important to store in a safe place and supply Hazeal Newman & Associates with your Director ID to be recorded for future reference.

Failure to complete the application for a Director Identification Number by the specified time frame can result in criminal or civil penalties. Penalties will also apply for proven cases of providing false identity information or intentionally applying for multiple director identification numbers.

If you have any questions, please contact Hazeal Newman & Associates.

SUPERANNUATION CHANGES FROM 1 JULY 2022

Changes for Employers and employees

Superannuation Guarantee increase to 10.5%

The Superannuation Guarantee (SG) rate on eligible employee wages will increase from 10% to 10.5% from 1 July 2022. The rate is set to increase by 0.5 percentage points each year until it reaches 12% by July 2025.

Lodging and Paying Super Guarantee on Time – we wish to remind clients who are employers that the due date for your employee SG payment is 28 days after quarter end. WARNING – with the introduction of compulsory STP reporting and use of superannuation clearing houses it means the Australian taxation office have this information at their fingertips. If you are late lodging and paying your SG, you must lodge the Superannuation Guarantee charge (SGC) statement and pay the penalty SGC. SGC payments are not tax deductible. Please ensure you are lodging and paying your SG on time as we are seeing an increase in ATO activity in this area.

Removal of $450 monthly income threshold

As of 1 July 2022, the $450 minimum monthly income threshold will be removed. This means workers, regardless of how much they earn, will be entitled to receive employer super payments. However, for employees under the age of 18, although the amount they earn is now irrelevant they must still work a minimum of 30 hours in a week to be entitled to superannuation, unless of course a specific award applies to your industry or a workplace agreement is in place stating otherwise.

Other Changes to Superannuation

Minimum Pension Requirements

The Government announced during the 2022-23 Federal Budget the continuation of the temporary reduction to the Minimum Drawdown rate for account based and transition to retirement pension accounts. For the 2022-23 (1/7/2022 to 30/06/2023) year the minimum pension requirements will again be set at half the normal minimum amount.

Abolishing the Work Test for people aged between 67 and 74

Current work test requires a person aged between 67 to 74 years of age to be employed for at least 40 hours in a consecutive 30-day period during the financial year, before any superannuation contributions can be made. This requirement from 1 July 2022 has been abolished and so anyone between the ages of 67 to 74 can contribute to super within the limits of the superannuation cap amounts. If you wish to claim a tax deduction on voluntary contributions then the work test will still apply as to whether you can claim that tax deduction.

Bring Forward Rules – extended to those aged under 75 provided conditions met

The annual non concessional contribution cap for 2022-23 is $110,000 per person provided your total superannuation balance is under $1,700,000.00 as at 1 July 2022. If you are under 75 years of age at any time in a financial year you may be able to make non-concessional contributions up to three times the annual non-concessional cap in that financial year. For the prior 2021-22 financial year this was only available to those aged under 67 and so this has been extended to include those now under age 75.

Again, conditions must be met to use the bring forward rule and so please check with your accountant whether you are eligible for this

New Age threshold for Downsizers

The Downsizer contribution age requirement has changed from 65 year or older to 60 years or older as of 1 July 2022. The Downsizer contribution allows a person to contribute up to $300,000 from the sale proceeds of their home into superannuation. The basic conditions for a person to access the Downsizer contributions are:

• The home must be in Australia and have been owned by you or your spouse for at least 10 years and the disposal must be exempt or partially exempt from Capital Gains Tax (CGT)

• You have not previously made a downsizer contribution to super from the sale of another home or from the part sale of your home

• You have reached the eligible age at the time you make a downsizer contribution. From 1 July 2022 this is 60 years of age or older (formerly 65). There is no maximum age limit

• You make your downsizer contribution within 90 days of receiving the proceeds of sale, which is usually at the date of settlement

• You provide your superfund with the Downsizer contribution into super form (NAT 75073) either before or at the time of making your downsizer contribution.

• A downsizer contribution does not count toward the Non concessional caps and can be made irrespective of total superannuation balance

MyGovID – WHAT IS IT AND DO YOU NEED ONE?

The short answer is, yes. The Government continues to make it quite clear through their correspondence and actions that the days of visiting Government offices or calling them are numbered. They continue to highly encourage (almost push) us as individuals and businesses into dealing with Government departments via digital platforms such as MyGov and the ATO business portal.

By now, most of us have at the very least heard of MyGov or are already using it. MyGov should not be confused with MyGovID (well that sounds confusing…). MyGov is the Australian Government’s online platform for an individual to access an array of services through a common portal by logging in with a username and password. Some of these services include:

- ATO

- Centrelink

- Child Support

- Medicare

- My Health Record

MyGov can be very handy and make it relatively easy to deal with ATO correspondence, lodging Centrelink forms, dealing with Medicare, etc.

MyGovID on the other hand, is basically an app on your smartphone that you download and follow the steps to verify your identity. Once you have this app and have completed the identity checks, you use MyGovID as your own personal distinct digital identity which can then be used to access Government services online, including MyGov.

Whilst it all sounds a little confusing, once you decipher what the differences are and what MyGovID can assist you with, it really is a very smart online identity system. Anyone involved in running a business or holding a directorship of a company will need one, as will individuals who want to access particular Government websites and deal with them online.

Our ongoing experiences as regular communicators with the ATO, ASIC, ABR, etc tells us that without the take up of this type of technology, you are going to have significant issues dealing with Government departments going forward. We understand how frustrating this is for certain people who say have no internet coverage, don’t have a smartphone or simply do not want to know about the technology. We certainly have our own frustrations with it ourselves at times, believe us when we say that! However, the technology is continually getting better and much more user friendly.

Earlier we mentioned the Director ID requirements. Having a MyGovID set up before applying for your director ID makes the application process easy. This is one of the many reasons why we recommend our clients create a MyGovID as soon as possible. If you have any issues setting up your MyGovID, give us a call and we can lend our support.

TAXABLE TRUST DISTRIBUTIONS ALERT!

Recently the ATO released a draft ruling, draft guidance and a taxpayer alert relating to trusts and Section 100A of the Income Tax Assessments Act 1936.

Section 100A is an anti-avoidance provision in the tax law that can impact the taxation of trust distributions. The issues surrounding the draft documents and tax alert are rather complex, however, to summarise, section 100A can apply in the following situation:

- The trustee makes an eligible beneficiary of the trust entitled to trust income;

- The trustee then, instead of paying the amount to the eligible beneficiary, retains the benefit within the trust or for the benefit of someone else;

- The arrangement is predominately entered into for the purposes of gaining a tax benefit.

- For example, the trust distributes taxable income to an adult child at university and/or a parent who is a self-funded retiree who have much lower tax rates than the persons who genuinely benefit from the trust distributions, hence saving tax; and

- The arrangement is not entered into in the course of ‘an ordinary family dealing’.

This section of the Tax Act has existed since 1979, however, it is only really in recent times where the ATO have taken a keen interest in their interpretation of it and where it can be applied.

Of concern is, if it is deemed that Section 100A applies to a distribution, then the trustee is liable for tax on the distribution at the top marginal tax rate plus Medicare levy which equates to a 47% tax rate.

Trusts are naturally complex from both a common law and tax law perspective. Exactly what the final ruling and guidance will be is still a little way off, however, it is clear that further consideration will need to be given in certain situations as the final documents will likely follow along the same lines as the drafts.

There are many potential issues that need some clarification as part of the final documents, especially ‘what is an ordinary family dealing’?

In the meantime, what do we and our clients who have family trust structures take away from this draft ruling:

- Historically accepted ‘aggressive’ tax planning strategies with family trust distributions may not be accepted by the ATO any longer;

- Trust distribution strategies and practices need to consider the ATO’s draft guidance when planning for 2022 taxable distributions and beyond; and

- Consider what is ‘an ordinary family dealing’? i.e. what is normal practice for your family? This does vary significantly from one family to the next and historically what you have done with money as a family unit, can help define what is normal and what is not.

Going forward care must be given where trust income is distributed to family members on lower marginal tax rates. If the money does not follow the distribution, then there is the potential for a distribution to be captured under this anti-avoidance provision and the penalty tax rate of 47% may apply.

TEMPORARY FULL EXPENSING EXTENDED

Many of our clients are Small Business Entities (SBE). If you are a SBE it is likely we have elected you for Simplified Depreciation. Under Simplified Depreciation a taxpayer pools their depreciable asset and generally claims 15% on new assets followed by 30% on that pool of assets every year thereafter. In the past the Government also allowed the full expensing of assets costing less than $1,000, this was known as the instant asset write off.

This threshold was increased to $150,000 from 12/3/2020 to 30/6/2021, however Government, in response to Covid, introduced Temporary Full Expensing from 6/10/2020. This has now been extended to 30/6/2023. Under this measure all assets can be written off in full regardless of their cost. Under current legislation this threshold is expected to revert back to $1,000 from 1/7/2023.

You can make a choice to opt out of Temporary Full Expensing for an income year on an asset-by-asset basis if you are not using the Simplified Depreciation rules. Historically, small businesses that have chosen to stop using the Simplified Depreciation rules have been prevented (‘lock out’ rules) from re-entering the simplified depreciation system for five years if they have opted out.

From 12/5/2015 to 30 June 2023 the ‘lock out’ rules are suspended. This allows small businesses that have chosen to stop using the Simplified Depreciation rules to take advantage of Temporary Full Expensing and the instant asset write-off during the suspended period and return to using the Simplified Depreciation rules by the end of this period.

If you are a SBE using Simplified Depreciation it may not always be most beneficial to Fully Expense every asset immediately. There will be no depreciation claim in future years unless new assets are purchased and when you sell or trade-in an item that has been fully expensed 100% of the proceeds will be taxable. Each taxpayer’s circumstances will be different and we will tailor a solution to fit.

We are monitoring your depreciation claims and will either depreciate in full or spread your claim over a number of years to minimize tax.

A NOTE FROM OUR BUSINESS PARTNERS AT MIDSEC

Midsec has been working with clients all over the EP for two decades and collaboratively with HNAA clients for a number of years.

How are you feeling about your investment portfolio and markets? We understand there’s a lot going on right now.

• The pandemic isn’t over.

• There’s a significant war under way.

• The cost of living is increasing along with inflationary expectations.

• Interest rates are on the rise.

• We have a change of Government.

There’s always something happening to spook investment markets, but this combination of issues is quite unique. Individually they’re not especially threatening, but all at the same time – well that could well be problematic!

In China the word for crisis is made up of the two characters, one that represents danger and the other opportunity. Pretty smart when you think about it. At one extreme, investors might opt for the security of cash to avoid danger, regardless of the potential loss of return. At the other extreme, they might sell their defensive assets and even borrow so they can look for things to buy.

But the ancient Chinese wisdom suggests the most logical course is cautious optimism, and that’s achieved by focusing on fundamentals.

The first and most important fundamental is confirming the quality of the investments you own. If the investments have substance, good long-term form, and financial strength, they’re likely to survive setbacks. The second fundamental is to keep a close eye on prices and consider shedding investments that are trading at levels well above their intrinsic value. And finally, if cash is available for investment and there aren’t high quality options available at reasonable prices, just hang onto the cash.

If you have any questions regarding your current retirement planning and investment portfolio, please contact the HNAA office and book a free no obligation consultation with one of our advisors.

We not only travel to Port Lincoln regularly but periodically travel all over the EP. We will work closely with your accountant to ensure a holistic approach is taken to your financial planning.

If you would like additional information, please visit our website:

https://www.midsec.com.au/

CAROL DUNN IS SET TO RETIRE ON 30TH JUNE 2022

Carol Anne Dunn joined Hazeal Newman & Associates on the 4 th of August 1986.

After 36 years, Carol has well and truly earnt the right to slow down and spend more time with her husband Milton and their ever increasing family.

The Directors and staff of Hazeal Newman & Associates would like to thank Carol for all her efforts and wish her a long and happy retirement.

BAS LODGEMENT PROGRAMME 2022/2023

If Hazeal Newman & Associates lodge your BAS

July—Sept 22 BAS —due approx. 25th November 2022

Oct—Dec 22 BAS —due approx. 28th February 2023

Jan— March 23 BAS —due approx. 26th May 2023

April—June 23 BAS —due approx. 25th August 2023

IF YOU LODGE YOUR OWN BAS the due dates are:

July—Sept 22 BAS —due 28th October 2022

Oct—Dec 22 BAS —due 28th February 2023

Jan— March 23 BAS —due 28th April 2023

April—June 23 BAS —due 28th July 2023